Business

CostStatus.com: Boost Your Budget with Accurate, Real-Time Data

In today’s fast-paced financial world, managing your budget efficiently can be challenging. Whether you’re an individual trying to save for the future or a business owner overseeing expenses, the need for accurate and real-time financial data has never been greater. Fortunately, CostStatus.com offers a solution to simplify budgeting and financial management. This platform provides users with up-to-the-minute insights, empowering them to make smarter, more informed decisions that can enhance their budgeting strategies.

In this article, we’ll explore how CostStatus.com can help you optimize your budget with real-time data, improving both your financial tracking and decision-making process.

Table of Contents

What is CostStatus.com?

CostStatus.com is a cutting-edge budgeting tool designed to help users manage their finances more effectively. By providing real-time data, the platform allows you to track your expenses, set budgets, and adjust financial plans instantly, making it a valuable resource for both personal and business finance management.

The key advantage of using CostStatus is its seamless integration with various financial accounts, allowing you to see all your expenses and revenue sources in one place. Whether you’re tracking daily expenses or working on long-term financial projections, the platform ensures that the data you’re using is both accurate and up-to-date.

Key features include:

- Real-time data tracking: Instant updates on your financial transactions.

- Customizable budget reports: Tailor reports to suit your specific budgeting needs.

- User-friendly interface: Easily navigate through your financial data, even if you’re not a financial expert.

How CostStatus Helps You Make Smarter Financial Decisions

One of the greatest advantages of CostStatus is its ability to provide real-time data, which is essential for making timely and informed financial decisions.

1. Real-Time Data Access

With the ability to monitor your finances in real-time, CostStatus.com helps you avoid unpleasant surprises. For example, if you’re a business owner and unexpected expenses arise, real-time data lets you immediately adjust your budget to reflect the new financial landscape. Likewise, if you’re managing a personal budget, you can tweak spending categories as soon as you notice you’re overspending in one area, preventing larger financial issues down the line.

2. Accurate Forecasting for Better Planning

CostStatus.com helps you look beyond current expenses by giving you the tools to forecast future spending. With access to accurate and up-to-date financial data, you can predict your financial outlook with greater accuracy. Whether planning for a vacation, preparing for tax season, or adjusting your business budget to accommodate new projects, the platform’s forecasting feature ensures that you have a reliable understanding of your finances at any given moment.

3. Real-World Example: Personal Budgeting

Take Sarah, a freelance graphic designer. She uses CostStatus to track her income and expenses. With the real-time tracking feature, she’s able to quickly see how much she’s earning each month and compare it against her outgoings. When a major client pays late, Sarah immediately notices the gap in her income and adjusts her spending on non-essential items. This instant insight helps her avoid overspending and keeps her financial plans on track.

Why Choose CostStatus.com Over Other Budgeting Tools?

While there are many budgeting tools available, CostStatus.com stands out for several reasons.

1. Comprehensive Financial View

Many budgeting tools only allow users to track one type of financial data, such as expenses or income, in isolation. In contrast, CostStatus.com integrates both revenue and expenditure, giving you a complete view of your financial health.

2. Customization and Flexibility

Unlike some rigid budgeting platforms, CostStatus.com is highly customizable. Users can adjust their financial categories, reporting style, and frequency of updates to match their unique needs. Whether you’re a business owner managing multiple revenue streams or an individual who wants to track spending categories like dining out, groceries, and entertainment, this platform allows you to set it up in a way that works best for you.

3. Data Security

Security is a top priority for CostStatus. With robust encryption protocols, you can rest assured that your financial data is safe and secure. Whether you’re syncing personal bank accounts or business financial information, the platform adheres to stringent security standards, keeping your information protected from breaches.

How to Get Started with CostStatus.com

Getting started with CostStatus.com is simple. Here’s a step-by-step guide:

- Sign Up: Visit the official CostStatus.com website and create an account.

- Link Your Financial Accounts: Integrate your bank, credit cards, and other financial accounts for automatic tracking.

- Set Up Your Budget: Customize your categories, set limits, and start tracking your spending in real-time.

- Monitor and Adjust: Use the platform’s forecasting tools to predict future spending and make adjustments as needed.

Conclusion

Managing your budget can be stressful, but with CostStatus.com, you gain access to the tools needed to make accurate, data-driven decisions. By providing real-time updates, customizable reports, and easy-to-understand insights, the platform ensures that you’re always in control of your finances. Whether you’re looking to optimize your personal finances or streamline your business budget, CostStatus offers the features and flexibility needed to succeed in today’s financial landscape.

Start today and boost your budget with accurate, real-time data from CostStatus.com—your partner in financial success.

Business

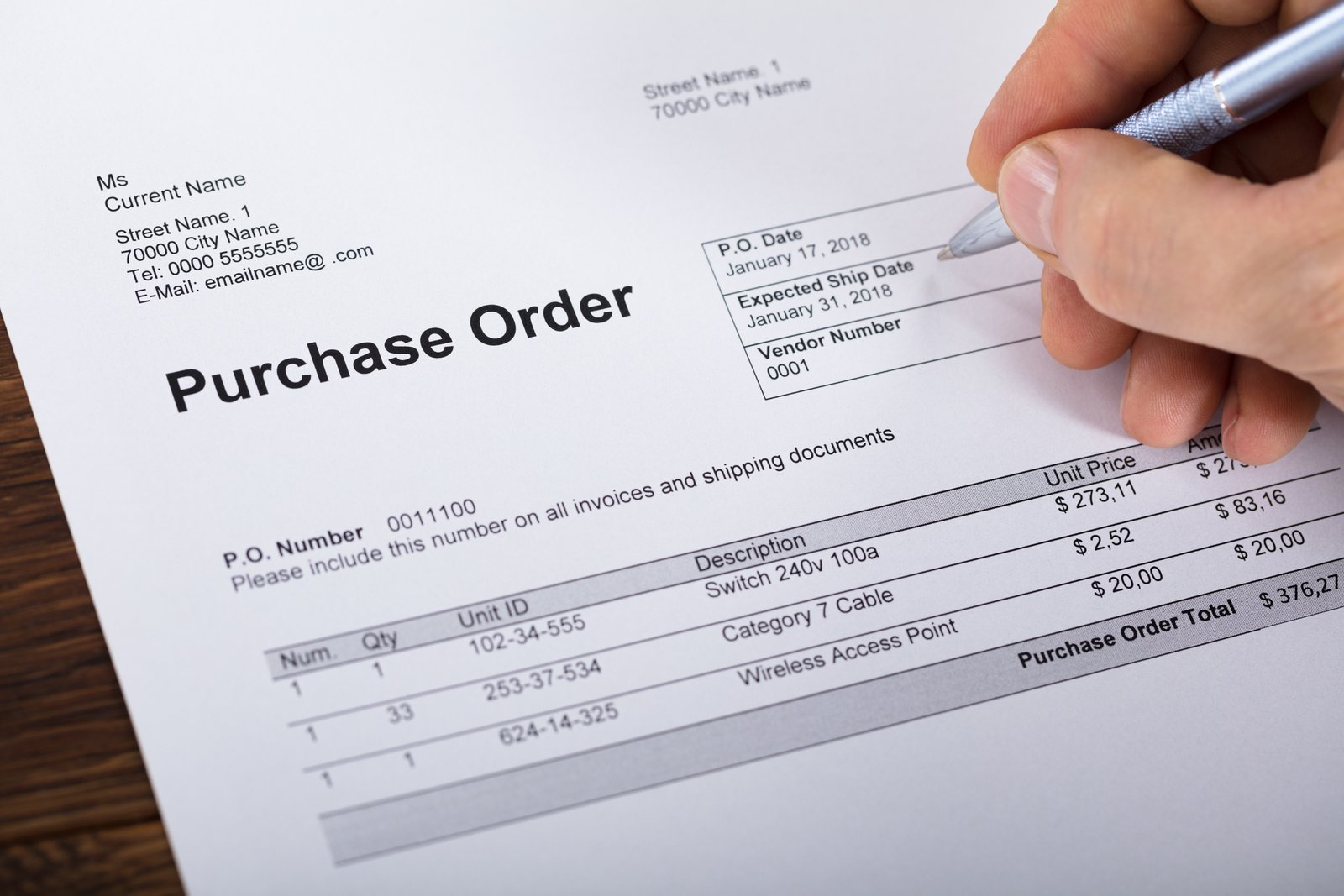

Why Every Growing Business Needs a Purchase Order Generator

As businesses grow, managing procurement efficiently becomes critical to maintaining smooth operations and controlling costs. Manual purchase order processes can be time-consuming, prone to errors, and difficult to track, especially when dealing with multiple vendors, departments, or locations. Delays or inaccuracies in purchase orders can result in stockouts, overstocking, and financial discrepancies, which can impact both operational efficiency and cash flow.

This is where a purchase order generator becomes an essential tool for growing businesses. By automating the creation, management, and tracking of purchase orders, businesses can streamline procurement, reduce errors, and improve overall operational efficiency.

Table of Contents

What is a Purchase Order Generator?

A purchase order (PO) generator is a tool or software that automates the creation of purchase orders. Instead of manually drafting documents for each procurement, businesses can quickly generate POs with all necessary details such as vendor information, item description, quantity, pricing, and terms.

Using a digital purchase order generator ensures standardization, accuracy, and faster processing, which is particularly valuable for businesses experiencing growth or managing complex supply chains.

Challenges of Manual Purchase Orders

Managing purchase orders manually presents several challenges:

- Human Errors: Manual entry increases the risk of typos, incorrect quantities, or pricing errors.

- Time-Consuming Processes: Drafting and sending purchase orders manually slows down procurement and delays operations.

- Lack of Visibility: Tracking POs across vendors and departments can be difficult, leading to missed deliveries or duplication.

- Difficulty in Compliance: Ensuring all POs are compliant with company policies or financial regulations can be cumbersome without automated workflows.

These challenges can hinder business growth, reduce efficiency, and negatively impact supplier relationships.

Benefits of Using a Purchase Order Generator

1. Automation for Efficiency

A purchase order generator automates the entire process, from creating POs to sending them to vendors. Automation reduces the time spent on manual tasks, allowing procurement teams to focus on strategic sourcing and supplier management.

2. Accuracy and Standardization

Using a generator ensures that all POs follow a standardized format with consistent details. This reduces errors in quantities, prices, and terms, leading to smoother procurement and fewer disputes with vendors.

3. Real-Time Tracking

Digital POs allow businesses to track the status of each order in real time. Procurement managers can monitor approvals, pending deliveries, and payment schedules, which improves overall visibility and accountability.

4. Enhanced Supplier Relationships

Clear, accurate, and timely purchase orders build trust with vendors. By using a purchase order generator, businesses ensure that suppliers receive correct orders on time, improving collaboration and reducing delays.

5. Integration with Business Systems

Many purchase order generators integrate with inventory, accounting, and financial systems. This ensures that stock levels, budgets, and cash flow are accurately updated whenever a PO is issued, providing a comprehensive view of business operations.

Supporting Growing Businesses

For growing businesses, the volume of purchase orders increases as operations expand. Manual processes become impractical and prone to inefficiency. Implementing a purchase order generator helps businesses scale their procurement processes without increasing administrative workload.

Moreover, businesses can leverage business tools and templates alongside their purchase order generator to streamline related processes such as invoicing, expense tracking, and budget management. This holistic approach ensures that procurement aligns with overall business operations and financial planning.

Cost and Time Savings

Automated purchase orders reduce the administrative effort required to manage procurement. Fewer errors mean fewer corrections and disputes, while real-time tracking prevents delays or mismanagement. This leads to significant cost savings and frees up resources for strategic initiatives, enhancing overall productivity.

Strategic Advantages of a Purchase Order Generator

A purchase order generator does more than just simplify documentation. It strengthens operational control, improves financial accuracy, and provides actionable insights into procurement patterns. Businesses can analyze trends, optimize supplier selection, and maintain consistent stock levels, all of which contribute to smoother operations and better cash flow management.

Streamlined Procurement for Sustainable Growth

In today’s competitive market, efficient procurement is vital for business growth. By adopting a purchase order generator, businesses minimize manual work, reduce errors, and gain greater control over their purchasing process. Integrating this tool with other business tools and templates ensures that all aspects of operations are aligned, creating a cohesive system that supports growth, compliance, and operational efficiency.

Business

Real Estate Agent Offenbach

When looking for a Immobilienmakler Offenbach it’s essential to find someone who understands both the city’s evolving market and your personal property goals. Offenbach, once considered a quieter neighbor to Frankfurt, is now a booming real estate hotspot in the Rhine-Main region. With its growing population, affordable housing options, and rich cultural scene, more buyers, sellers, and investors are turning their attention to Offenbach. Whether you’re planning to purchase your first home, invest in rental properties, or sell your apartment, choosing the right agent can make all the difference.

Table of Contents

Why Offenbach is an Emerging Property Hub

Located just across the Main River from Frankfurt, Offenbach offers the perfect blend of urban convenience and residential charm. In recent years, Offenbach has undergone significant urban renewal projects, attracting young professionals, families, and creative industries. The city’s proximity to Frankfurt makes it ideal for commuters, while property prices in Offenbach remain more accessible. This affordability combined with ongoing development makes it a smart investment choice. A skilled real estate agent in Offenbach will help you navigate this growing market and find the best opportunities.

The Role of a Real Estate Agent in Offenbach

A real estate agent does much more than show properties. In a competitive market like Offenbach, a local agent acts as your advisor, negotiator, and guide through the entire process. They provide insights into market trends, pricing, neighborhood growth, and legal requirements. Whether you are a buyer or seller, a good agent ensures smooth communication, accurate paperwork, and fair negotiations. In Offenbach’s fast-evolving districts, having someone with up-to-date knowledge and strong connections is a major advantage.

What to Look for in an Offenbach Agent

Choosing the right Offenbach real estate agent requires more than browsing websites. Look for agents who specialize in your specific needs—residential, commercial, investment, or rental. Check for licenses, client testimonials, years of experience, and knowledge of neighborhoods like Bieber, Bürgel, or Kaiserlei. The best agents are transparent, patient, and proactive. They should listen to your needs, offer honest assessments, and not push you into decisions. Strong local expertise is vital, especially as new developments reshape the city’s housing landscape.

Neighborhood Insights: Where to Buy or Sell in Offenbach

Offenbach boasts diverse neighborhoods that appeal to different types of buyers. Bieber is ideal for families due to its schools and quiet streets. Kaiserlei, located near the border with Frankfurt, is a prime location for professionals and investors due to its office developments and excellent transport links. Lauterborn and Tempelsee offer a mix of modern housing and green spaces, making them popular among young couples. A local real estate agent will help you identify which areas match your lifestyle or investment goals—and guide you to the best listings.

Services Offered by Real Estate Agents in Offenbach

Top agents in Offenbach provide a range of services to streamline the buying or selling process. These include property valuations, professional photography, virtual tours, targeted marketing, staging consultations, and open house coordination. For sellers, they create compelling listings that attract serious buyers. For buyers, they offer customized searches, arrange viewings, assist with financing, and manage negotiations. Some agents also offer multilingual services—especially useful in an international city like Offenbach where many buyers come from abroad.

The Importance of Local Knowledge

Offenbach’s real estate market is dynamic and still evolving, especially with upcoming construction projects, new business hubs, and rising rental demand. A real estate agent with deep local knowledge can offer insights that online platforms or out-of-town agents simply can’t. For example, understanding future infrastructure plans, school zone changes, or market trends in a particular district can help you make smarter decisions. Whether buying or selling, insider knowledge translates into better deals and faster transactions.

Real Estate for Expats and International Buyers

Offenbach’s proximity to Frankfurt and its growing global community make it increasingly attractive to international buyers. For expats, navigating German property laws and processes can be confusing. A real estate agent who speaks English and understands international client needs can be a huge help. From explaining contract terms to guiding you through mortgage approvals and notary appointments, these agents simplify the experience. Many also assist with rental investments, helping foreign buyers find tenants and manage properties remotely.

Top-Rated Agencies and Independent Agents in Offenbach

There are several reputable agencies and independent realtors in Offenbach. Firms like Engel & Völkers, Von Poll Immobilien, and Immobilienservice RheinMain have strong presences in the area and offer professional services backed by experience. At the same time, many independent agents also offer personalized service, with flexible hours and in-depth local knowledge. When choosing, compare client reviews, recent sales, and their familiarity with the neighborhood you’re interested in. A good rapport and clear communication are just as important as credentials.

Final Thoughts: Partnering with the Right Agent

Offenbach’s real estate market offers immense potential for buyers, sellers, and investors alike. But success in this competitive environment depends heavily on working with the Immobilienmakler Offenbach. The ideal agent will not only guide you through the practical steps but also offer valuable insight that leads to smarter decisions. Whether you’re drawn to Offenbach for its affordability, location, or growth potential, a trusted agent will help you make the most of your real estate journey. Take the time to research, ask questions, and choose someone who understands your goals—and Offenbach’s promising future.

Business

Education Loan Explained: Eligibility and Advantages

Quality higher education can lay the foundation for a successful and fulfilling career. However, the rising cost of education often becomes a challenge for many students and their families. In such a case, opting for an education loan can be a suitable option. An education loan helps students cover their financial requirements without putting pressure on their families. There are many banks and Non-Banking Financial Companies (NBFCs) that provide education loans at competitive rates. This article explains what education loans are, their advantages, eligibility criteria, and more.

Table of Contents

What is an Education Loan?

A loan for education is a type of financial aid offered by banks or financial institutions to help students pay for their higher education. This loan generally covers all the expenses such as tuition fees, accommodation, books, travel (if studying abroad), and other related costs. These loans can be used for studying in India or abroad. Some education loans also offer flexible repayment options and allow students to begin repayment after completing their course.

Eligibility Criteria for an Education Loan

The eligibility for an education loan may vary from lender to lender, but the common requirements include:

1. Nationality

To qualify, an applicant must be an Indian citizen. It’s important to note that loan options, interest rates, and repayment terms can vary across banks and financial institutions, so comparing lenders is essential before applying.

2. Academic Qualification

The student must have secured admission to a recognised institution in India or abroad through an entrance test or merit-based selection. This helps lenders ensure that the loan is given to students pursuing serious and credible courses. The institution should be accredited or approved by the relevant education authorities. Proof of admission is usually required during the loan application process.

3. Age Limit

Generally, the applicant’s age should be between 18 to 35 years at the time of applying for the loan. Some lenders may have slight variations in age criteria depending on the course or loan scheme. This age range is considered suitable as it aligns with most students pursuing higher education. In certain cases, older students may be eligible but may need to fulfil additional requirements.

4. Course and Institution

The loan is usually sanctioned for professional or technical courses like engineering, medical, management, and similar fields from recognised universities. One thing to note is that lenders prefer courses that offer strong career prospects. This makes them sure that the student will be able to repay the loan after completing his/her studies. Some lenders may also provide loans for diploma or vocational courses if they meet certain criteria.

5. Co-applicant

A co-applicant (usually a parent or guardian) is mandatory. The co-applicant’s income and credit history are considered to determine loan approval and amount. Having a reliable co-applicant increases the possibility of getting a higher loan amount and better loan terms. The co-applicant is equally responsible for repaying the loan if the student is unable to do so.

Advantages of Education Loans

Education loans offer several benefits that make them a preferred financing option for students:

1. Financial Independence

Thanks to education loans, students can attend the institution and pursue the course they want, without relying only on the family’s savings or selling valuable assets. This means they can concentrate on learning, since their needs are taken care of. With educational loans, students can choose what they want to study, regardless of how much funds they have now.

2. Affordable Repayment Options

Students can be given more time to pay back the loan, often during the duration of the course and for several months after its completion. Therefore, interest and loan payments are not required right from the beginning. You can pay back the loan in smaller instalments over an extended time.

3. Tax Benefits

Under Section 80E of the Income Tax Act, the interest paid on education loans is tax-deductible for up to 8 years. This can reduce your overall tax burden significantly. However, the benefit applies only to the interest, not the principal loan amount.

4. Covers a Wide Range of Expenses

Apart from tuition, loans may cover costs like accommodation, travel (for foreign studies), exam fees, and other educational materials. This helps students manage all education-related expenses in one place. Some loans also include funds for internships or training programs linked to the course.

5. Improves Credit Score

Timely repayment of education loans, along with managing the education loan interest rates responsibly, helps build a strong credit history. This tends to make it easier to secure other loans in the future.

Conclusion

For students aiming to get a quality higher education, education loans give them the confidence to focus on their studies rather than their budget. If students meet the eligibility criteria and decide on the proper loan, they can easily manage fees for schooling and get improvements in their credit scores, plus enjoy better tax terms and hassle-free repayment. With support from banks and NBFCs, education loans make it easier to focus on learning and building a secure future. If you plan carefully and repay on time, an education loan can support you in building your career.

-

Games1 year ago

Games1 year agoMeerut City Satta King: Your Ultimate Guide to Winning!

-

Blog1 year ago

Blog1 year agoThe Importance of Hiring Commercial Movers

-

Business1 year ago

Business1 year agoDiscover Why debsllcs.org/ Is Leading in Sustainable Business Solutions

-

Tech1 year ago

Tech1 year agovstechpanel.com Off-Page SEO: Boost Your Site’s Authority Now!

-

Tech11 months ago

Tech11 months agoWhy SEO is No Longer Just About Rankings

-

Tech1 year ago

Tech1 year agoHow Do I Contact Hong Kong Reverse Technology Now for Solutions?

-

Fashion1 year ago

Fashion1 year agoEssentials Clothing: Bold Statements in Minimalist Designs

-

Entertainment1 year ago

Entertainment1 year agoIncestflix: Controversial Platform Raising Serious Concerns